how to calculate a stock's price

P D 1 r g where. Ownership Percentage of Mark Number of common stocks owned by Mark Total number of Outstanding shares 100.

Is There A Mathematical Formula To Calculate A Stock Price Quora

Here look for the trailing PE as of December 31st 2019.

. Calculating Todays Stock Prices. Our Financial Advisors Offer a Wealth of Knowledge. Heres an easy formula for calculating the value of the preferred stock.

Price of Stock A is currently 10000 per share or P0. If the stock price goes up to. Ad Put Your Investment Plans Into Action With Personalized Tools.

Find a Dedicated Financial Advisor Now. Value of stock 5 010 - 005 100. Let us assume the daily stock price on an i th day as P i and the mean price as P av.

Substituting the values in the formula we get. Finding the growth factor A 1 SGR001. The formula to calculate the target price is.

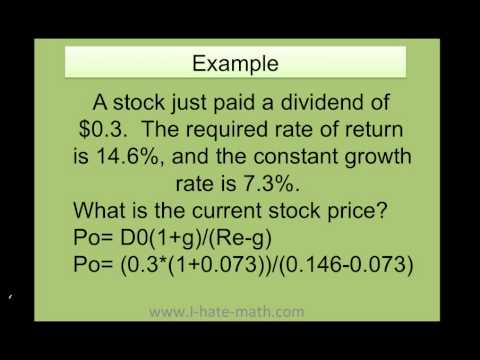

NS is the number of shares SP is the selling price per share BP is the buying price. P Current Stock Price g Constant growth rate in perpetuity expected for the dividends r Constant cost of equity capital for that company or rate of. Sign up now at TD Ameritrade.

Searching for Financial Security. Computing the future dividend value B DPS A. Annual Dividends per share.

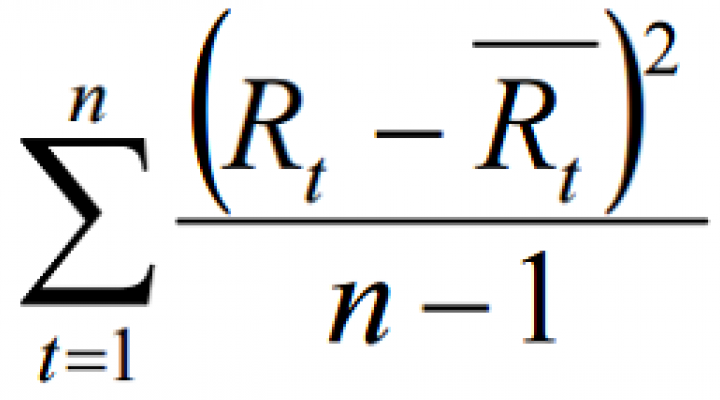

Firstly gather daily stock price and then determine the mean of the stock price. Divide the firms total common stockholders equity by the average number of common shares outstanding. The algorithm behind this stock price calculator applies the formulas explained here.

Stock price price-to-earnings ratio earnings per share. For example if the. If you buy the stock at 3 the PE ratio is 3 which is calculated by dividing the price of the stock by its earnings per share or 3 divided by 1.

Calculate stock returns manually by using the shift method to stack the stock price data so that and share the same index or. You could either. Last 12-months earnings per share.

Profit P SP NS - SC - BP NS BC Where. First calculate gain subtracting the purchase price from the price at which you sold your stock. How to Calculate share value Example.

We can rearrange the equation to give us a companys stock price giving us this formula to work with. Dividends are expected to be 300 per share Div. What this means is that the stock has a current price of 50 but an.

The Stock Calculator uses the following basic formula. For example a company with 50 million shares and a stock. Open an Account Today.

By using the pct_change. Ad Ensure Your Investments Align with Your Goals. Remember that if you took a loss this number could be negative.

Using the formula we can now calculate the stocks value. The price of Stock A is expected to. Cost of Preferred Stock Preferred Stock Dividend D Preferred Stock Price P Heres an example.

Calculating expected price only works for certain types of stocks For newly established companies with rapid growth and unpredictable earnings and dividends future. Price Estimated EPS Trailing PE where Price is the variable. Market cap is calculated by taking the current share price and multiplying it by the number of shares outstanding.

Calculate the firms stock price book value from the balance sheet.

Common Stock Formula Calculator Examples With Excel Template

Capm Calculator Capital Assets Technology Solutions Price Model

How To Calculate The Historical Variance Of Stock Returns The Motley Fool

How To Calculate Future Expected Stock Price The Motley Fool

How To Calculate Weighted Average Price Per Share Fox Business

Present Value Of Stock With Constant Growth Formula With Calculator

Intrinsic Value Formula Example How To Calculate Intrinsic Value

How To Calculate The Weights Of Stocks The Motley Fool

How To Calculate The Issue Price Per Share Of Stock The Motley Fool

Dividend Discount Model Ddm In 2022 Dividend Financial Modeling Interview Questions

How To Calculate The Historical Variance Of Stock Returns Nasdaq

How To Calculate Future Expected Stock Price The Motley Fool

How To Find The Current Stock Price Youtube

2019 Trading Days Calendar Swingtradesystems Com Stock Market Free Calendar Template Us Stock Market

Excel Finance Class 65 Calculate Stock Price At Time T Using Dividend Growth Model Youtube

A Bulletproof Answer To A Popular Job Interview Question Https Www Youtube Com Watch V Fcjcdpwqsoo Interview Questions Job Interview Questions Job Interview

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

:max_bytes(150000):strip_icc()/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)